Have you experienced the surprise violation on a driver’s annual Motor Vehicle Record (MVR) check?

Motor Vehicle Record (MVR) Reports are one of the most useful tools for maintaining driver qualification, onboarding new drivers, underwriting and managing insurance policies, and improving insurance rates.

In this blog post, we’ll explore the new advancements in MVR Reports and provide insights on:

- What Does A Motor Vehicle Driver Record Tell You

- Auto Adjudicating MVR’s – What Is It and the Benefits

- Monitoring Risk with MVR’s – How It Maintains Driver Qualification

- How MVR’s Are Used to Improve Insurance Rates and Policy Underwriting

First, let’s review what a Motor Vehicle Record tells you, and what are some of the new advancements to expect from MVR services.

What Does A Motor Vehicle Record Tell You?

MVR reports give insurers and fleet managers a snapshot into a driver’s DMV record.

Here’s What’s Typically Included:

- Driver’s License Information

(Driver Name, Height, Weight, Date of Birth, etc.) - Violations

- License Status (Active/Suspended/Revoked)

- Misdemeanor Moving Violations/Convictions

- Accidents

- State-Based Driving Record Points

Auto Adjudicating MVR’s - What Is It and the Benefits

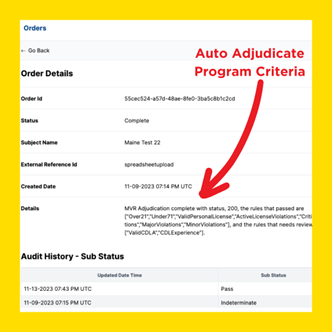

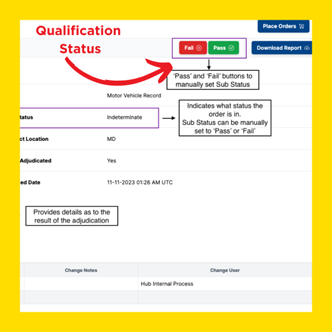

As automation and data analytics continue to improve the transport of goods, vehicles and drivers, it has made its way into screening services like Motor Vehicle Records, too. Using a MVR service equipped with auto adjudication can have a positive impact on insurance, safety and driver qualification.

Auto adjudicating MVR’s helps insurers and fleet managers eliminate administrative work, costs and errors (typically associated with manual MVR processing), expedite policy approvals with greater accuracy, and maintain driver compliance and qualification status.

HOW IT WORKS

- Automate a “Pass” or “Fail” return based on your program criteria

- Instantly see and address why a driver received a “fail” status

- Quickly find the right insurance coverage with greater accuracy

- Expedite the insurance approval process and get more drivers onboarded and insured faster

An Example MVR Scenario

1 manual MVR screening takes approximately 15 minutes to review x 1,000 drivers = 250 hours of admin time.

Auto adjudicated MVR’s take seconds.

Monitoring Risk with MVR’s - How It Maintains Driver Qualification

Some motor carriers and insurers require that drivers are responsible for self-reporting incidents in between annual Motor Vehicle Record (MVR) checks. But, often, not everything is reported. This creates a gap in the driver’s motor vehicle record where violations, incidents, crashes and status/license changes can occur but remain unknown.

Relying solely on drivers to self-report violations can be risky when it comes to assessing driver risk as it relates to insurance policies and driver qualification.

DID YOU KNOW?

It’s common for drivers to be unaware of existing violations on their record like unpaid child support resulting in a suspended license.

Utilizing a risk monitoring service in combination with regular MVR checks gives historical insights into driver behavior, unreported incidents and potential violations that may disqualify a driver.

Monitoring Notifications Include:

- Driving violations (such as drug/alcohol, speeding, traffic, loading, parking, etc.)

- License status and class

- Crashes

- Other non-driving incidents

How Risk Monitoring Works

- Automated violation alerts and insights are sent to your dashboard

- Quickly intervene before license points accumulate

- Avoid inflated insurance rates due to high-risk

How MVR’s Are Used to Improve Insurance Rates and Policy Underwriting

Motor Vehicle Records are usually pulled at policy renewal or hiring time, but what about the other 364 days in the year? What does your drivers’ risk look like? How do you know if they’ve had a violation or incident AFTER the initial MVR was pulled? Without regular screening and monitoring, you don’t.

By running regularly scheduled MVR checks multiple times per year, or adding a risk monitoring service, insurers and fleet managers are informed of any new violations year-round, automatically. Risk reporting provides vital insights into a driver’s motor vehicle record – enabling fleet managers to intervene before a violation escalates into accumulated license points and eventually, a higher insurance premium.

Why It’s Important to Run Regular MVR Screenings

- Ensures a driver’s license is in good standing

- Confirms if a driver meets company safety criteria

- Reveals violations and accidents that can turn into liability

- Identifies risky behavior that can be corrected

- Informs insurance risk and policy coverage

Uncover Risk with Time-Sensitive Alerts

Around 3 to 5% of individuals on the roads are driving with a suspended license.

Under FMCSA regulations, an employer is required to request a pre-hire MVR in all states where a CDL license was held within the previous 3-year period. Although MVR’s are not federally mandated for final mile fleets, many employers adhere to annual screenings as part of the driver qualification process.

For optimal safety, risk scores and insurance premiums, it’s recommended that every driver has an annual MVR check.

Understanding and utilizing new technologies – like ClearConnect Solutions’ advanced, auto adjudicated Motor Vehicle Reports and Risk Monitoring services – is imperative to staying ahead of competition, lowering insurance premiums, operational efficiency and safety.

SCHEDULE A DEMO or CONTACT US to learn more about ClearConnect Solutions’ MVR and Risk Monitoring Services.